Tuesday, August 22, 2006

Return to Risky Assets?

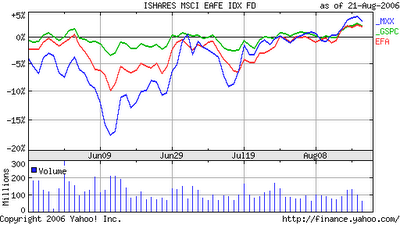

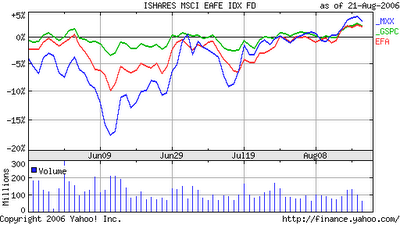

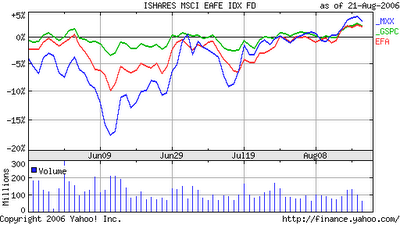

here's a 3 month chart comparing the MSCI EAFE, Mexican IPC, and S&P 500. It really depends on what you're looking for and the time period you're looking at as to what conclusions you can draw from this comparison. That being said this chart is a little surprising to me, although maybe it shouldn't be. Doesn't look to be much upside left in emerging markets unless the US experiences a sustained, committed rally (not likely) - world markets are falling more with bad US news and rising comparatively less with the good. Another reason to be skeptical of last week's rally.

Subscribe to:

Post Comments (Atom)

NYSE/Euronext Merger

Enter the current share prices for NYSE and Euronext, as well as the USD/Euro Exchange rate and hit "calc" to view relevant data. Deal was announced 6/1/2006.

No comments:

Post a Comment