Given that the terms have been disclosed for the NYSE/Euronext merger and it includes a cash payout along with share conversion for Euronext shareholders, it will be interesting to see what happens to the prices of those stocks. When you consider that the cash payment is in euros along with the fact that Euronext is traded on three exchanges (I'm only using the Paris price from the

euronext site) you get enough variables to create any number of potential plays on this merger.

From the NYSE/Euronext merger details from the June 1 announcement (from the

NYSE website):

NYSE shareholders get 1 share of the NYSE Euronext stock per NYSE share.

Euronext shareholders get 0.98 shares of NYSE Euronext stock plus a cash payment of 21.32 euros per Euronext share.

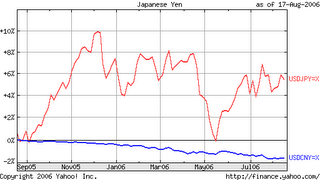

Using yesterday's share prices ($60.00 for NYX, Eur 66.40 for NXT.PA) at yesterday's exchange rate (1.284 Eur/$), you get a $US 85.26 share price for Euronext stock which has a current value of $86.17 (0.98 NYSE shares x $60.00/share + Eur 21.32 x 1.284 Eur/$) - a nice and tidy $0.91 profit per share. That of course assumes that the $60/share market price is the accurate valuation for the new NYSE Euronext stock. If all euronext stock were converted at 0.98 to 1 and NYSE stock 1 to1, there would be a total of 264.52 million shares of the new NYSE Euronext stock. At $60 per share, thats a market cap of $15.87 billion compared to the NYSE estimate of $20 billion. Obviously they benefit from overestimating the valuation, but 4+ billion seems like a rather large discrepancy.

Consider another alternative - the current valuation of each company added together equals the total valuation for the new NYSE Euronext. Under this assumption, total market cap would be $18.8 billion, with a share price of $71.09. If the share price of the NYSE Euronext reaches that level, the current value of holding 1 share of Euronext stock rises to $98.46, a $13.20 per share profit over the current purchase price of $85.26...

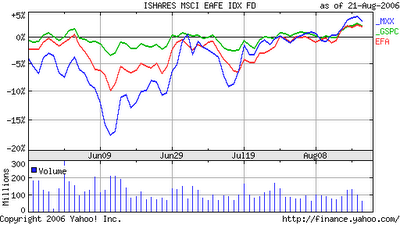

It all comes down to where you feel the new NYSE Euronext stock price will fall, and I don't see how it can be any lower than $60/share regardless of what the NYSE price does in the near future. The movement in the NYSE seems to be consolidating around the $60 a share price, and the ratio of NYSE stock price to performance of the underlying stocks (represented by NYC price) is 0.78, with the Nasdaq having a share price to underlying stock value (measured by QQQQ price) of 0.76. You also get to play the dollar's decline by being in Euronext (the cash is in euros).

Throw a third party into the mix and you get even more options. Here is the ratio of the Nasdaq share price to NYSE share price - it has just bumped above the 90-day MA and the Nasdaq looks like it is poised to continue this uptrend versus the NYSE...Nasdaq has kind of sat back watching the NYSE-Euronext tie up and you know they will make a move at some point for the LSE, and I think they will ultimately be successful.

Sorry for all the numbers in today's post, but I thought it essential to taking a look at potential plays in this situation. The exchanges are extremely difficult to value to begin with, so you get a lot of valuations that really haven't been around long enough to have a track record. Who really knows what they're worth? There are so many potential ways to go about it, and you would think at some level the success of the exchanges depends upon the success of their member stocks. The sector has a wild west feel to it right now, and it just feels like the next few years will have been the time to have done the analysis and made the more profitable plays on exchange stocks. There are less and less of them, and they will only become more stable as valuation methodologies mature and the m&a activity in this sector eventually slows.